Mikael recently sat down with Tuuli McCully to discuss the state of the Vietnamese Economy.

Tuuli is the former Asia-Pacific chief economist at Scotiabank and is currently an economics PhD researcher at Aalto University as well as Managing Director at AuSiO Economics.

Mikael: Good morning, Tuuli. Thank you for the opportunity to discuss Vietnam’s economic outlook with you.

Due to Kenno’s concentrated approach, it’s important for us to constantly challenge our own assumptions, and not fall in love with the companies we invest in. Same goes for the countries we invest in – we want to stay objective and data-driven!

Tuuli: Good morning, Mikael. It’s my pleasure to be here with you today.

Mikael: Can you tell us a bit about your forecast for Vietnam’s GDP growth in the coming years?

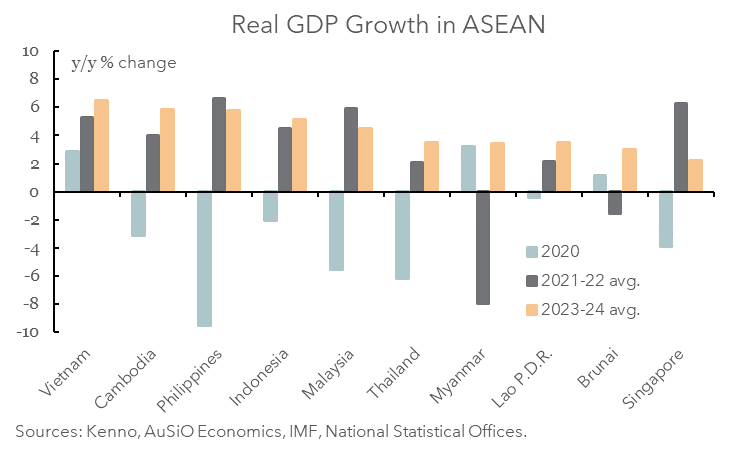

Tuuli: Despite global headwinds, we forecast that Vietnam’s real GDP growth will average 6.5% y/y in 2023-24, which is the strongest expected expansion among its ASEAN peers.

Last year, Vietnam recorded a large output gain of 8.0% on the back of rebounding activity after challenging COVID-19 conditions in 2021.

Mikael: That’s good to hear, because we also believe that the Vietnamese economy will continue to outpace the rest of the region. Can you elaborate on why you think Vietnam can continue to grow at such breakneck speed, despite the global uncertainty?

Tuuli: Domestic demand will be a key growth driver amidst softer global demand.

Following a strong recovery in retail sales in 2022, household consumption will likely moderate somewhat on the back of squeezed disposable incomes due to inflationary pressures and higher interest rates. However, rebounding tourism activity, particularly the expected resumption of Chinese arrivals in 2023, will support sentiment and the labour market recovery.

Mikael: How about private sector investment? How do you see that contributing to Vietnam’s growth?

Tuuli: While the outlook for private sector investment is somewhat cautious on the back of global uncertainties, Vietnam will continue to attract sizable foreign direct investment inflows as firms globally are diversifying their supply chains.

Thanks to Vietnam’s sound public finances, fiscal policy will be able to underpin economic activity over the coming quarters. The government’s sizable economic recovery programme (around USD 15 billion, equivalent to 4.1% of Vietnam’s GDP), announced in early 2022, will continue to spur production and business activities through tax relief and liquidity support, and will underpin the country’s longer-term development goals through investment spending on health, transport, green, and digital infrastructure

Mikael: This begins to sound like a paid advertisement for Kenno’s fund, because domestic consumption remains the core investment theme in our portfolio.

However, you don’t sound so convinced about the external demand, which is still an important part of the Vietnamese economy. With everything that is happening in the U.S. right now, how do you see it impacting Vietnam?

Tuuli: Vietnam’s external sector will reflect developments in its main trading partner economies. The US, Vietnam’s most important export market, is proving to have a sounder-than-expected economy.

Nonetheless, elevated inflation and higher interest rates will work to cool off the US economy over the coming months, likely suppressing demand for imports from Vietnam in 2023. Similar dynamics are expected to occur in Europe, which buys around 15% of Vietnamese exports.

Meanwhile, the Chinese economy, Vietnam’s second-largest export market and a destination for 17% of its shipments abroad, is set to rebound this year and provide some welcome counterbalance. After this year’s soft patch in demand in some advanced economies, we foresee a rebound in trade activity in 2024.

Mikael: I wish either of us had the proverbial crystal ball – that would make our job as investors much easier! For now, we will have to stick to our ability to identify quality companies that are able to grow over the economic cycle.

Before we wrap up this chat, could you give us your opinion on the recent adjustments to Vietnam’s monetary policy?

Tuuli: Sure. The State Bank of Vietnam, which uses a combination of interest rates to conduct monetary policy, loosened monetary conditions twice in March to provide support to the economy. It reversed some of the monetary tightening implemented last year.

The central bank lowered the benchmark refinancing rate by 50 basis points to 5.5%, the rediscounting rate and the overnight rate were reduced by 100 basis points to 3.5% and 6%, respectively, and the cap on the lending rates for short-term loans in certain sectors were lowered twice, first to 5% followed by another cut to 4.5%.

The monetary easing move highlights policymakers’ concerns regarding the uncertain global outlook and domestic liquidity challenges. The lower rates will help reduce the cost of funds for banks and allow them to reduce their lending rates to businesses, supporting domestic activity.

We do not expect the central bank to ease monetary policy further in the near future, as it will focus on assessing the impact of the March rate cuts on the economy, inflation, and the Vietnamese dong.

Mikael: That’s interesting, because it means Vietnam is going against the trend of other central banks that are still tightening their monetary policies in order to fight inflation. How is Vietnam managing price pressures?

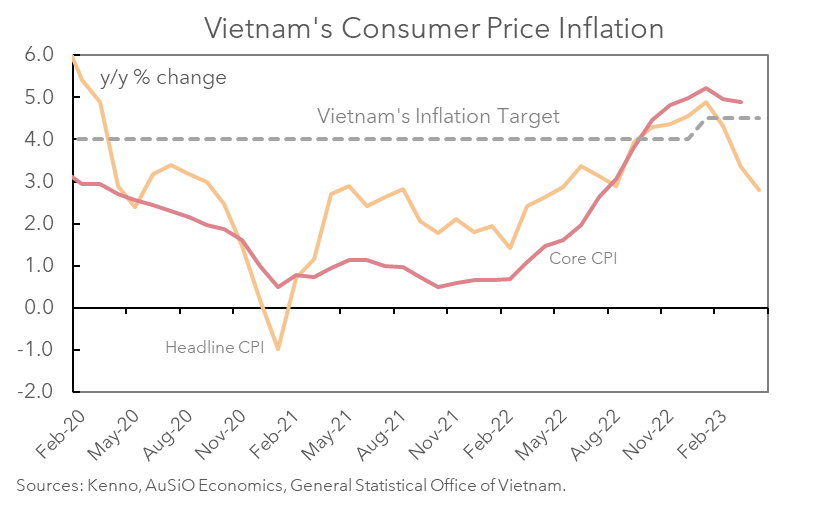

Tuuli: Global commodity prices and supply chain disruptions caused inflationary pressures in Vietnam, but price pressures have started to ease and are manageable compared to many of Vietnam’s regional peers. Consumer price inflation weakened to 2.8% y/y in April, below the official 2023 target of 4.5%, and we expect inflation to hover around 2.5-3.0% y/y over the coming months. While policymakers prioritize economic growth over inflation, they’ll remain vigilant enough to manage inflationary risks and expectations.

Mikael: I agree with you, and it will be interesting to see how the Vietnamese economy continues to develop in the coming quarter. Perhaps we need to do a follow-up later in the year!

It was great to talk to you today, and I hope you have a great day ahead.

Tuuli: Thank you for having me, Mikael. It was my pleasure to share my perspective on Vietnam’s economic development.